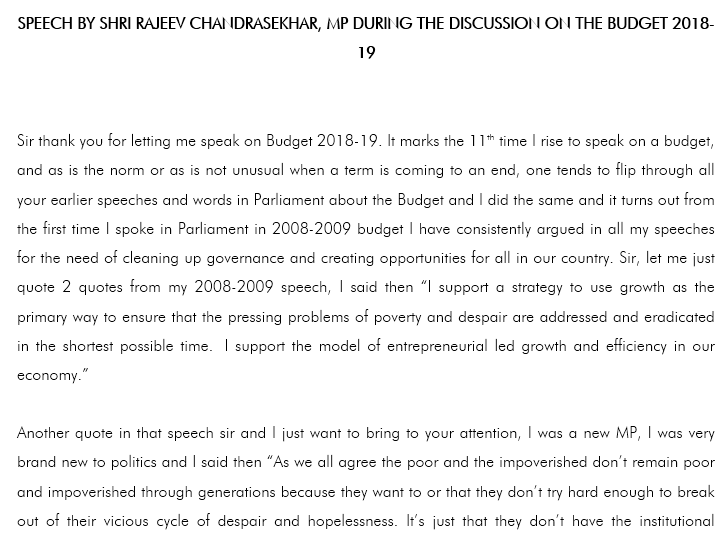

Rajeev Chandrasekhar has focused on and taken up a wide array of macro-economic and micro-economic issues in his two terms in Parliament. These include the restructuring of Public Sector Banks, creating Transparency in the management of Public Assets and repairing key sectors in the economy to revive growth amongst others.

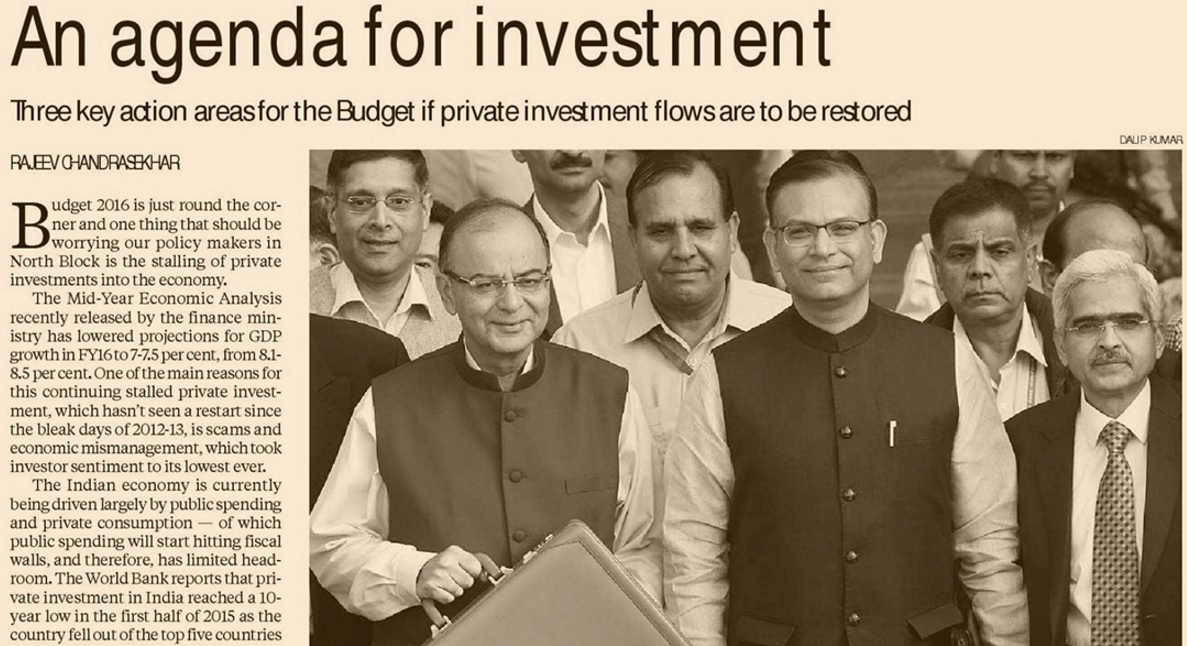

Rajeev advocates for the creation of a new architecture, a coherent economic vision, prudent financial management and a team of credible leaders to ensure revival of the economy. He believes that there is a need to redefine the role of the Government and restore credibility of government institutions.

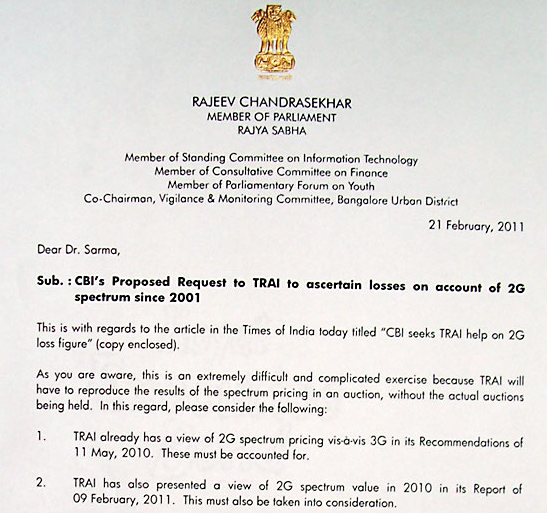

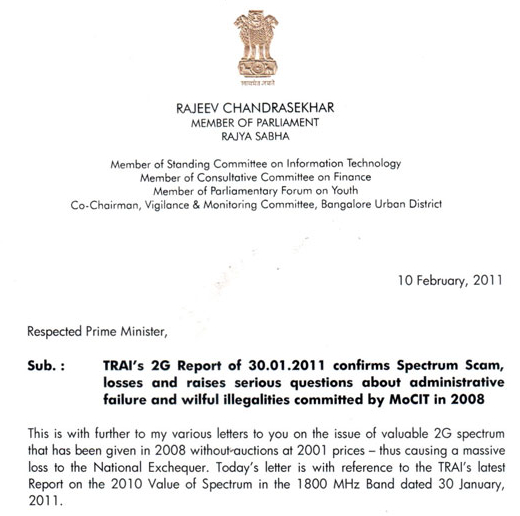

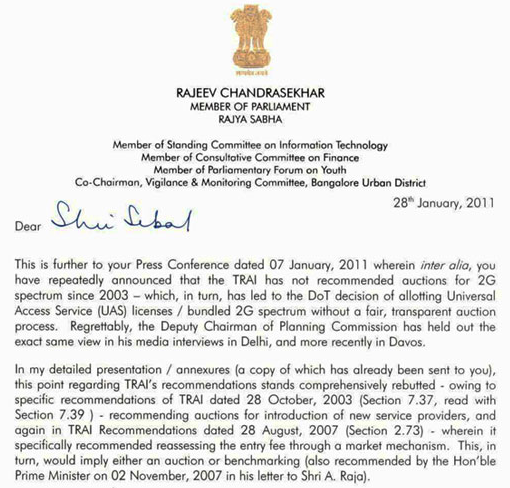

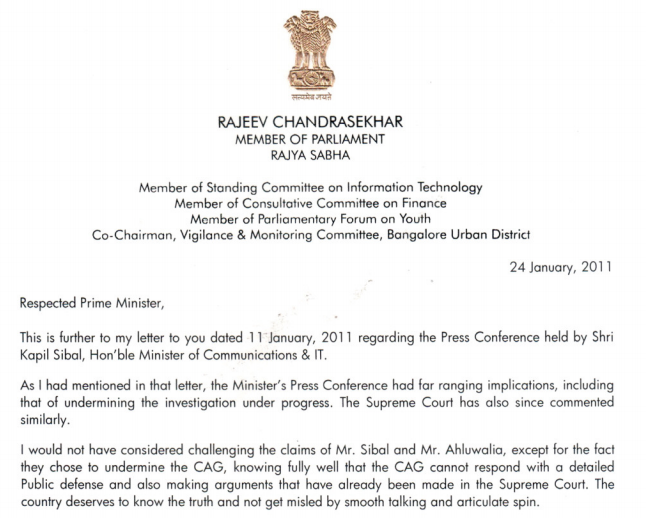

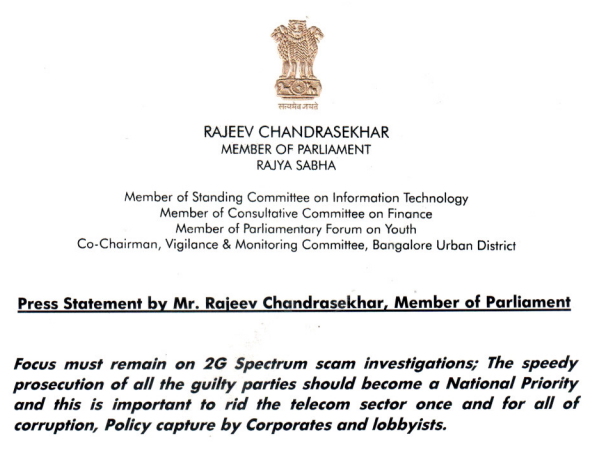

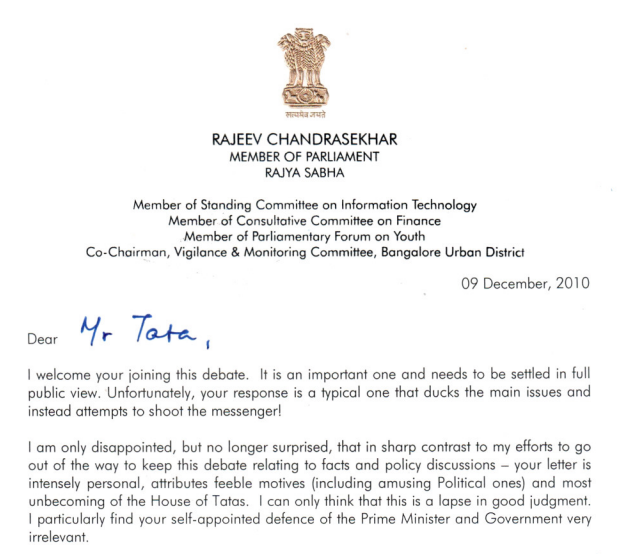

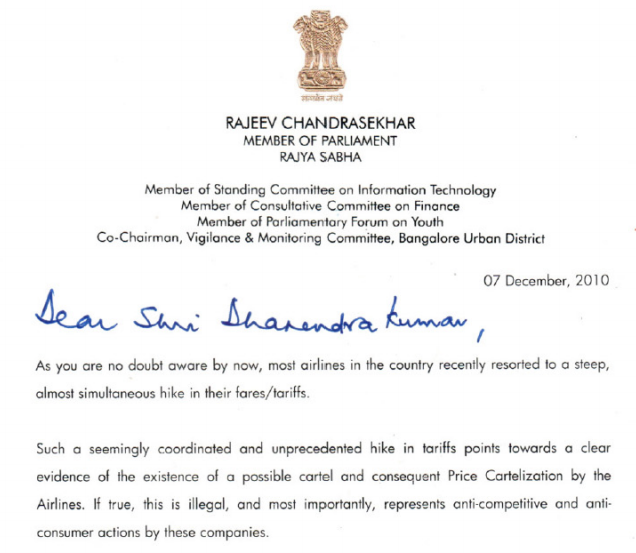

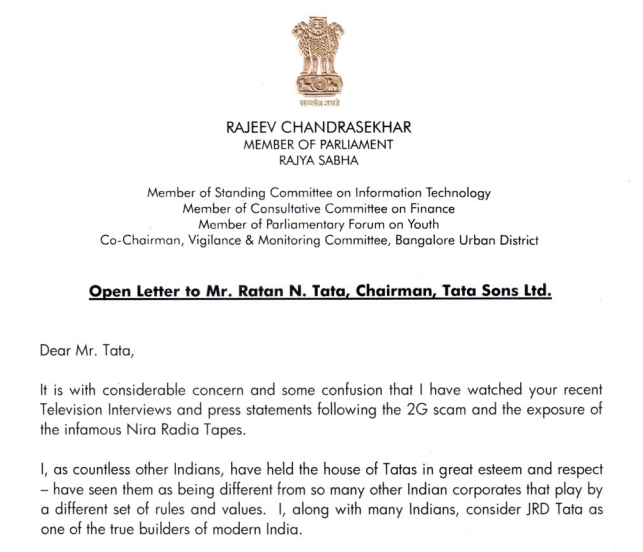

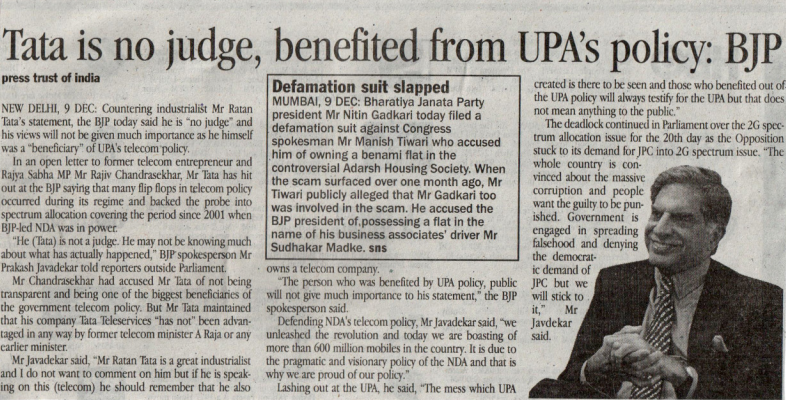

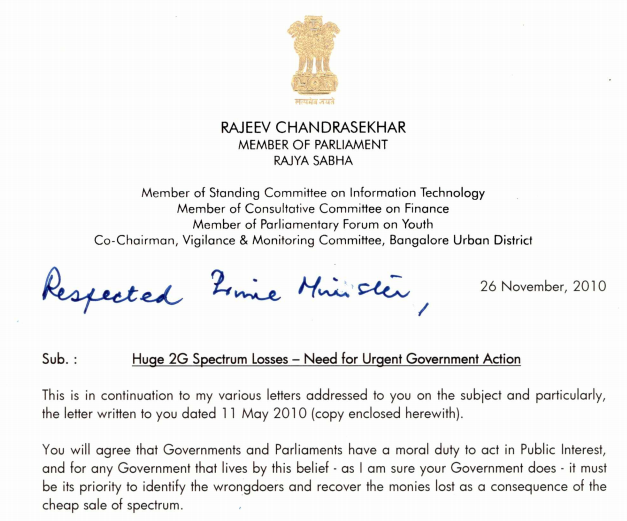

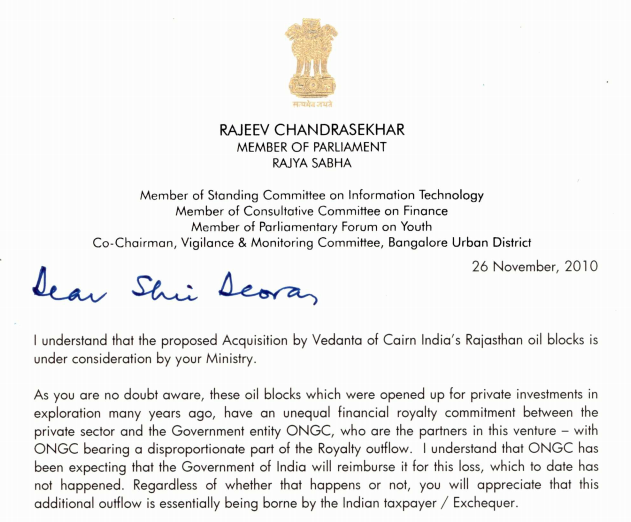

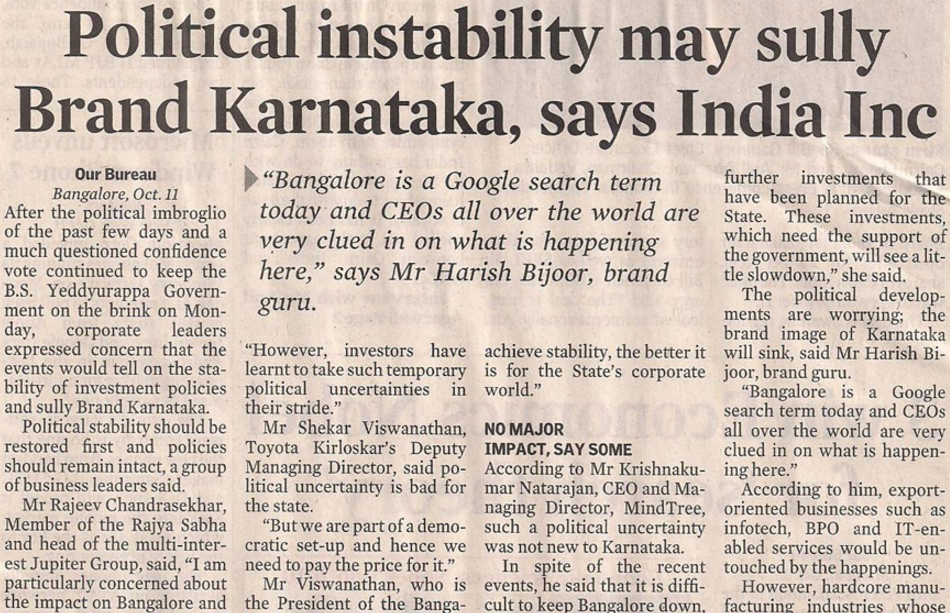

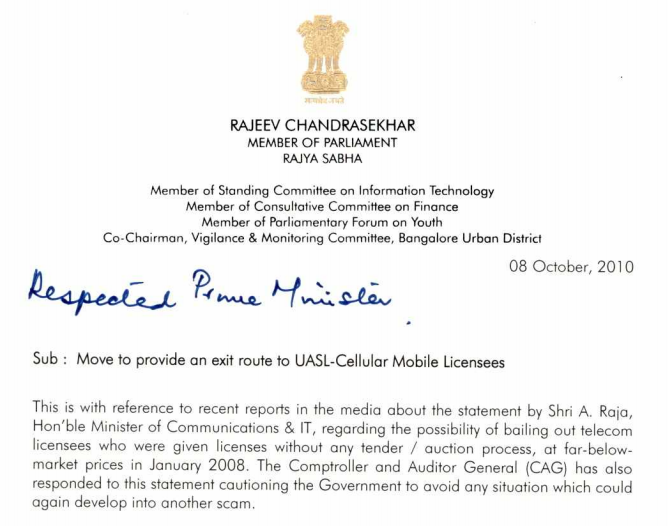

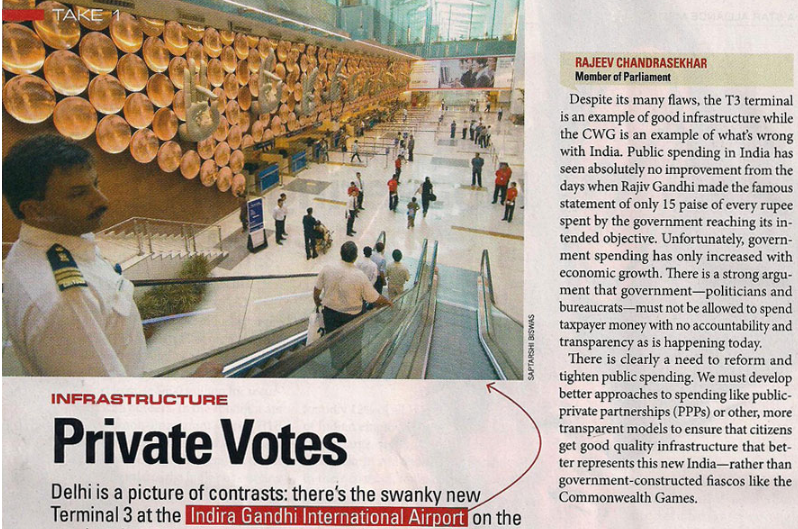

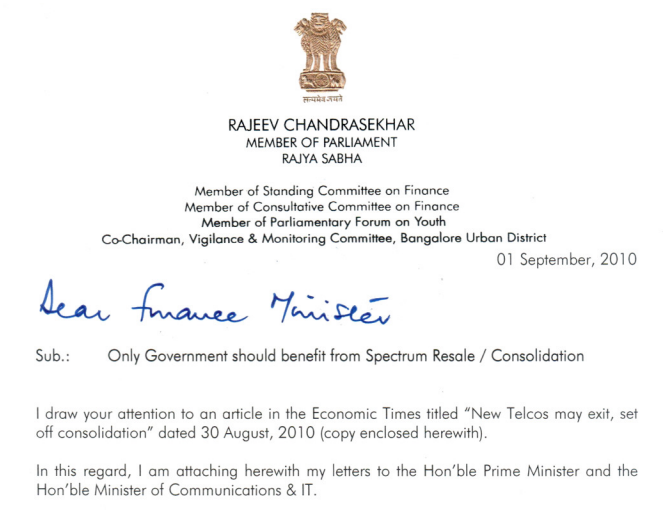

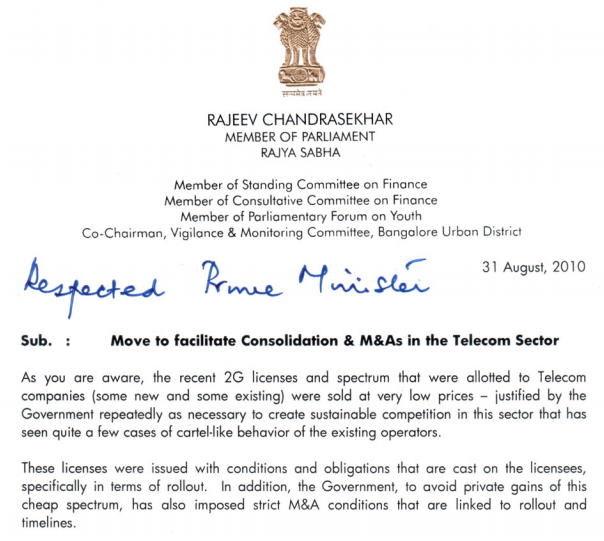

With Transform India, Rajeev has focused on multiple areas providing solutions and roadmaps to many critical issues pertaining to the Government of India’s economic and governance policy decisions. Rajeev’s insight made him one of the first individuals to raise concerns regarding the ad hoc allocation of 2G licenses in 2008 – which in the years to come became one of the main indictments against the UPA government.

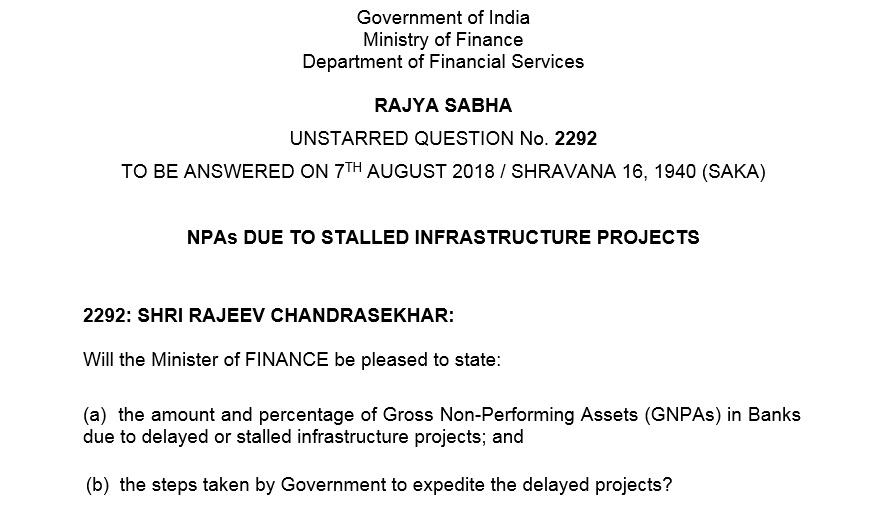

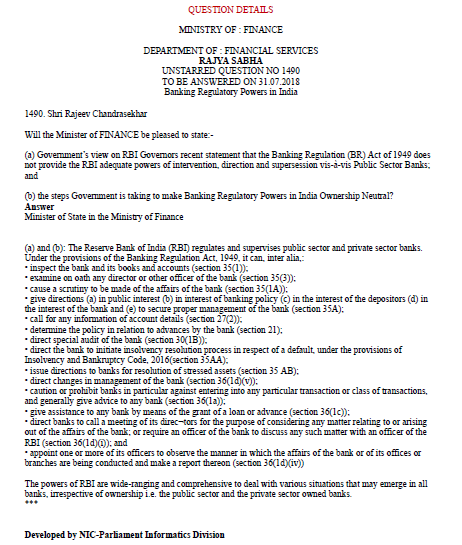

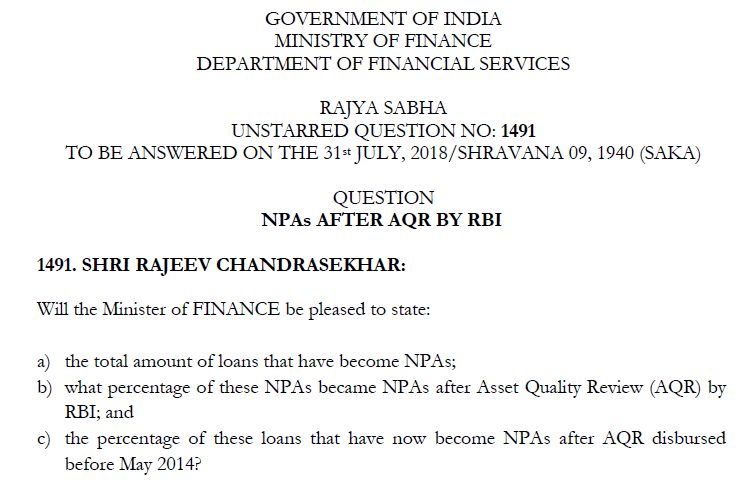

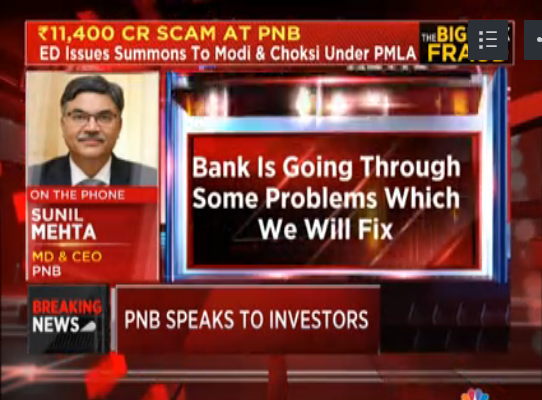

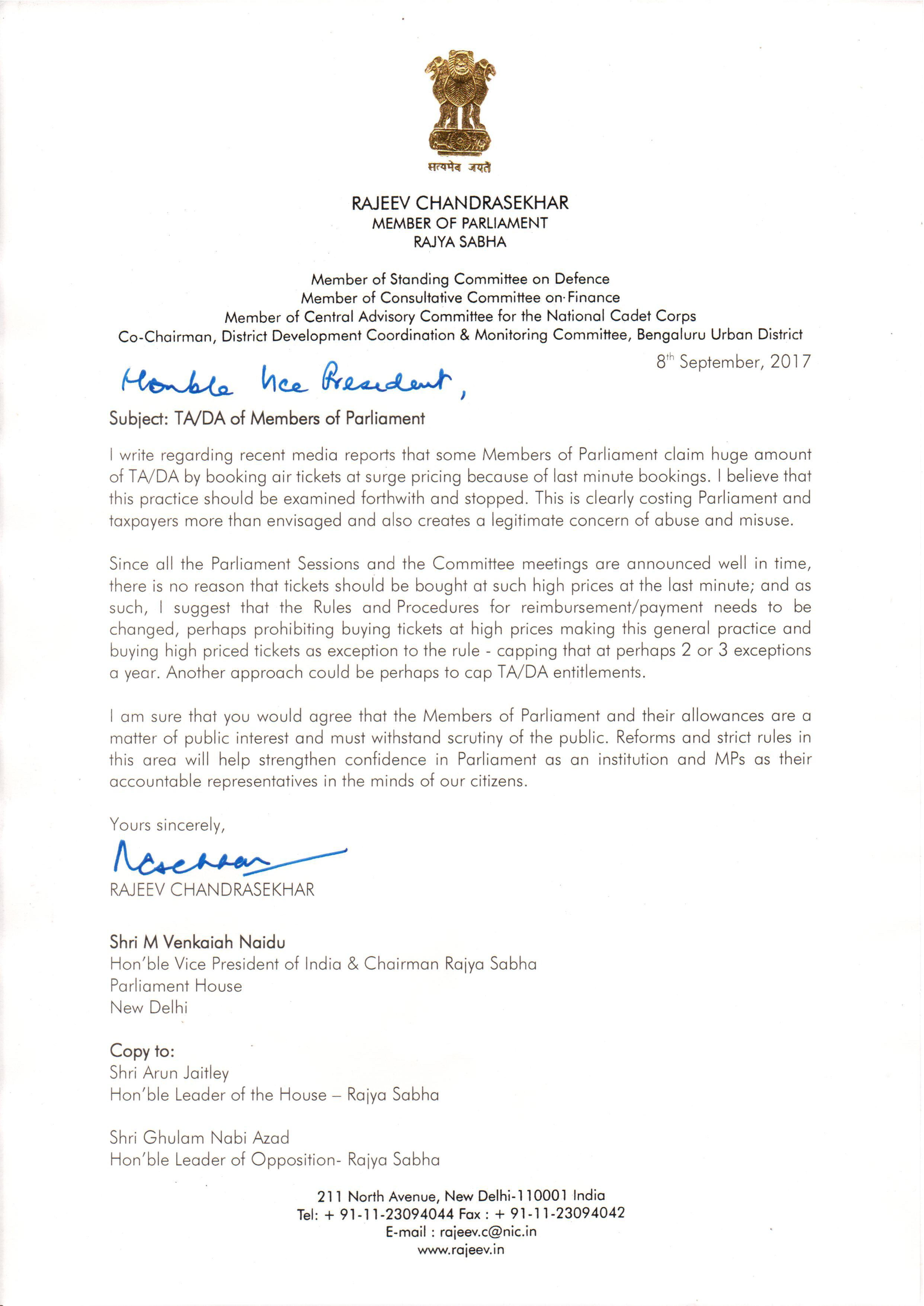

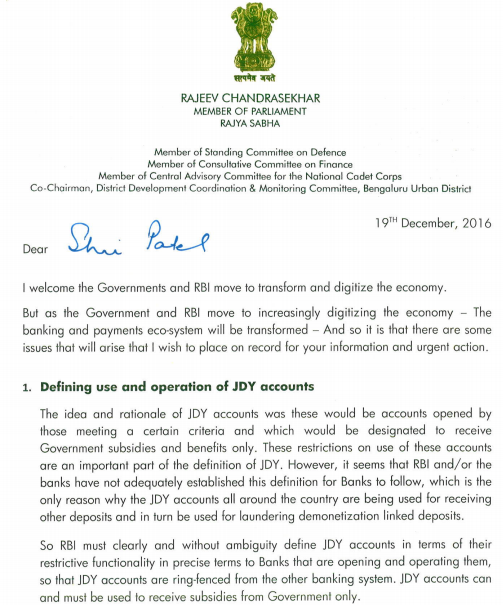

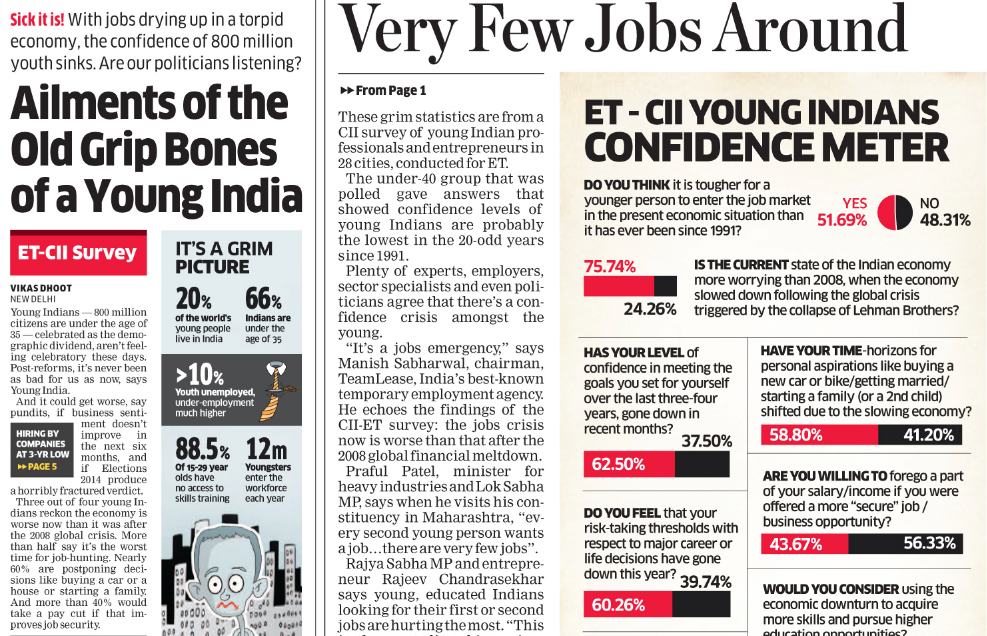

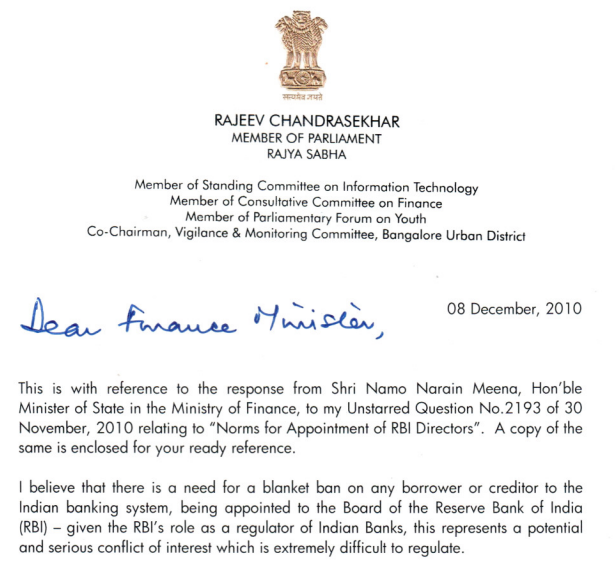

Rajeev has asserted the need for reforms in the public sector banking (PSB) system and has urged the Government to consider stronger mechanisms for installing an internal culture of transparency and accountability in decisions taken by PSBs. He has highlighted the seriousness of the issue of Non-Performing Assets in PSB’s as it involves Tax payers’ money and advocated a joint effort by the Government, RBI and the Board of Management of the Banks.

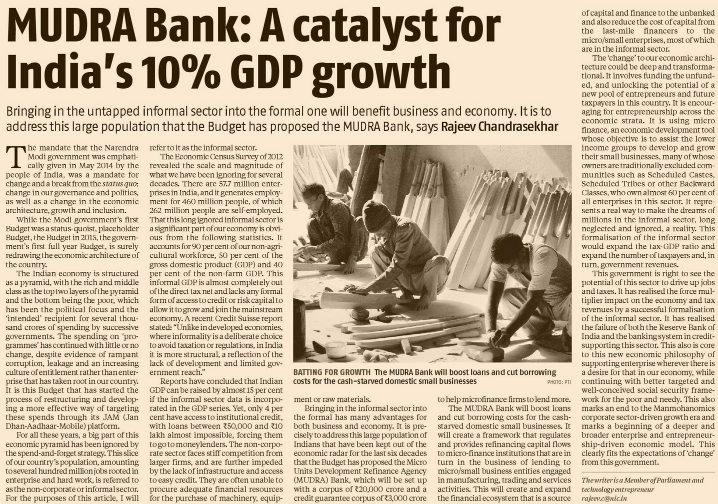

Rajeev has over the past ten years advocated for an integrated approach to Economic reforms in the country that address issues of banking, manufacturing & production and technology & governance. Rajeev has maintained that most important structural moves are the creation of a social security net via pension and insurance, and the MUDRA bank that will also bring the bottom of pyramid into the economy.

A strong votary for Transparency in Governance, Rajeev feels the change in the government’s approach towards public assets is in itself a transformation. Rajeev has maintained that there is a need for a comprehensive public policy especially when it involves commercial terms of monetisation of public assets like spectrum, minerals, natural resources, etc. He firmly believes a public policy should be based on a simple objective and test of ensuring maximum benefits to the exchequer and public

A proponent for Independence in monetary policymaking in India just as it is recognised the world over, Rajeev maintains that important and first steps towards reforming the economy must entail decisive governance and policy action that spurs foreign and domestic equity investor sentiment and restart equity investment cycle.

Highlighting that the issue of deciding on interest rates has resulted in much friction between the government and the RBI, Rajeev believes the RBI should be kept autonomous even if it does not pander to government’s expectations all the time.

The 'change' to India’s economic architecture according to Rajeev could be deep and transformational. It involves funding the unfunded, and unlocking the potential of a new pool of entrepreneurs and future taxpayers in this country

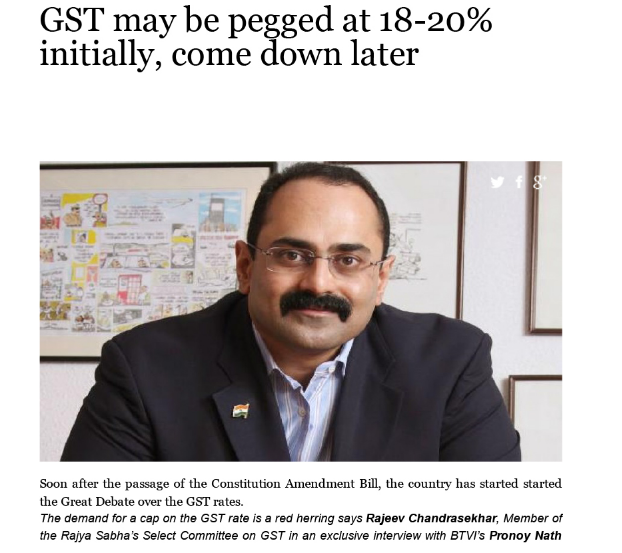

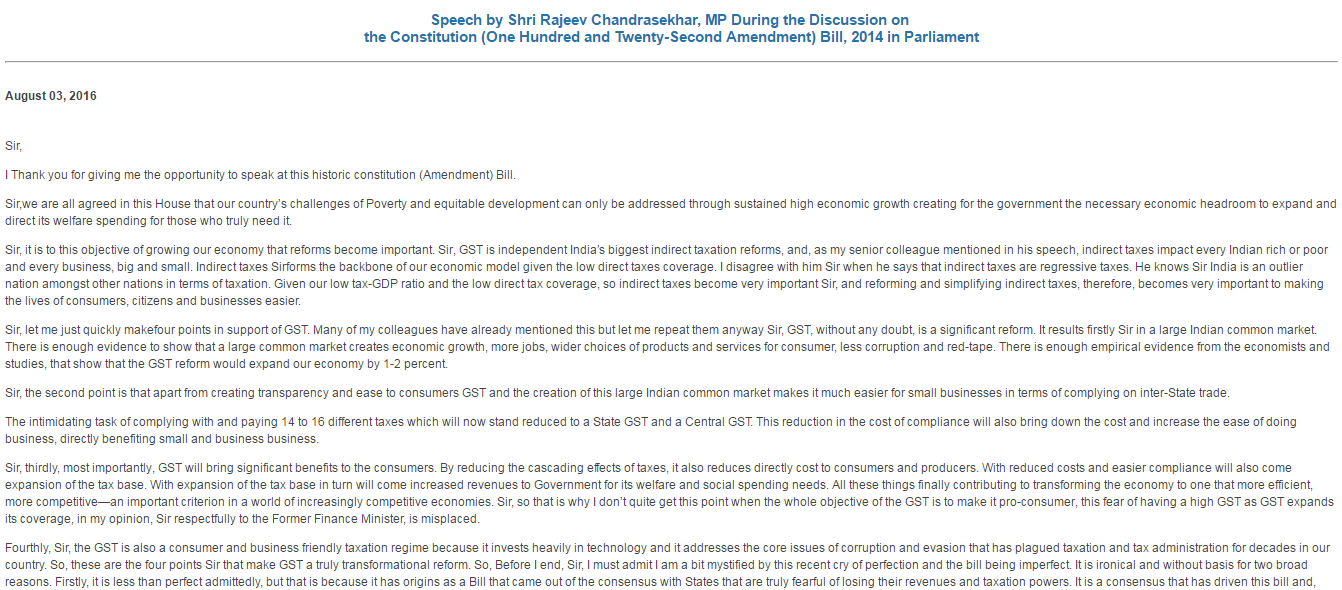

Rajeev has served on select committees that finalised legislations like GST, Insurance, Mines & Mineral Regulation Bill, Auctions in Spectrum and the Real Estate Regulation Bill amongst others.

-

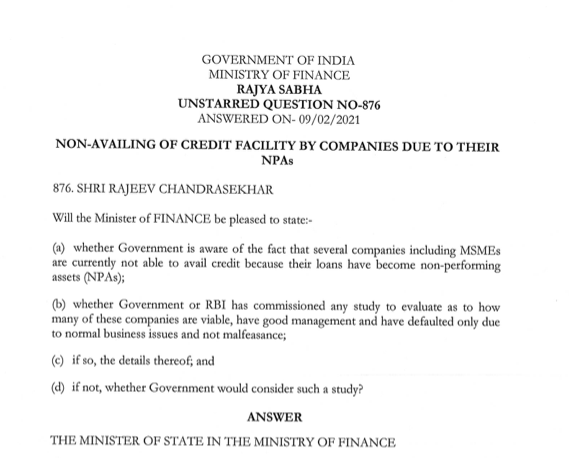

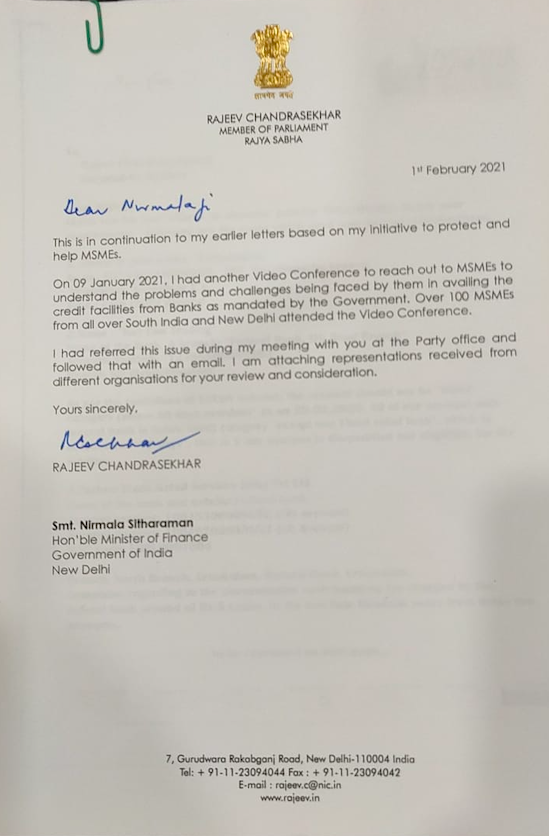

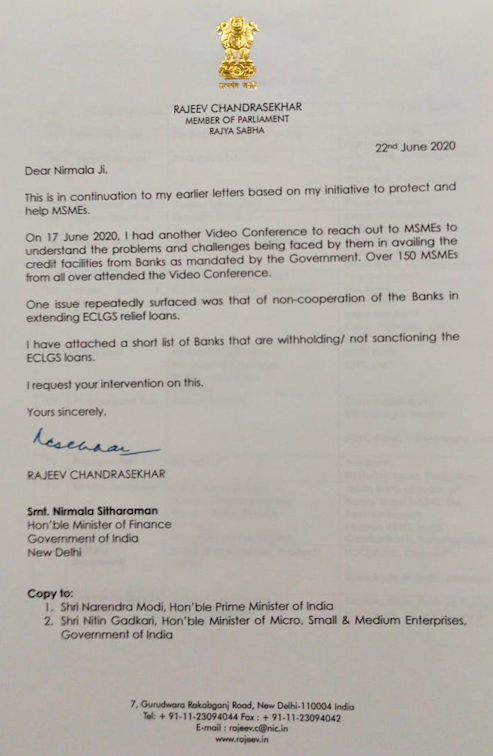

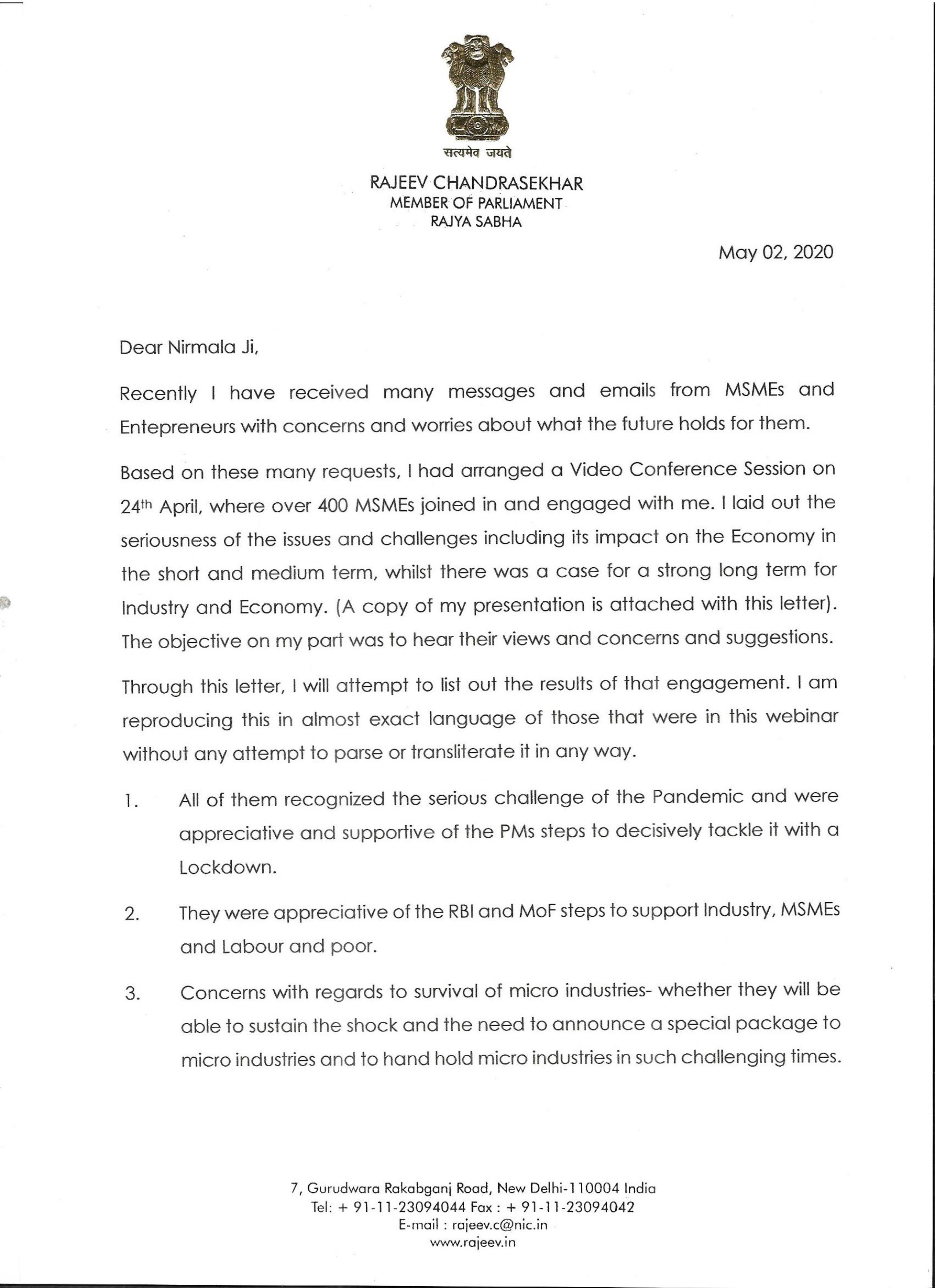

Rajeev asks Question in Parliament on non availing of credit facilities by companies including MSMEs due to their NPAs

Unstarred Question No : 876 Parliament Session 253 -

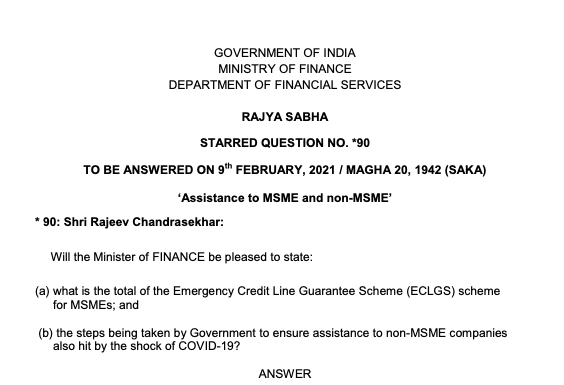

Rajeev asks Question in Parliament on assistance to MSMEs and non-MSMEs under the ECLGS scheme

Starred Question No : 90 Parliament Session 253 -

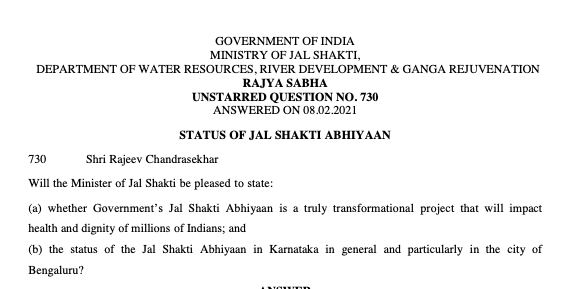

Rajeev asks Question in Parliament on the STATUS OF JAL SHAKTI ABHIYAAN IN BENGALURU AND KARNATAKA

Unstarred Question No : 730 Parliament Session 253 -

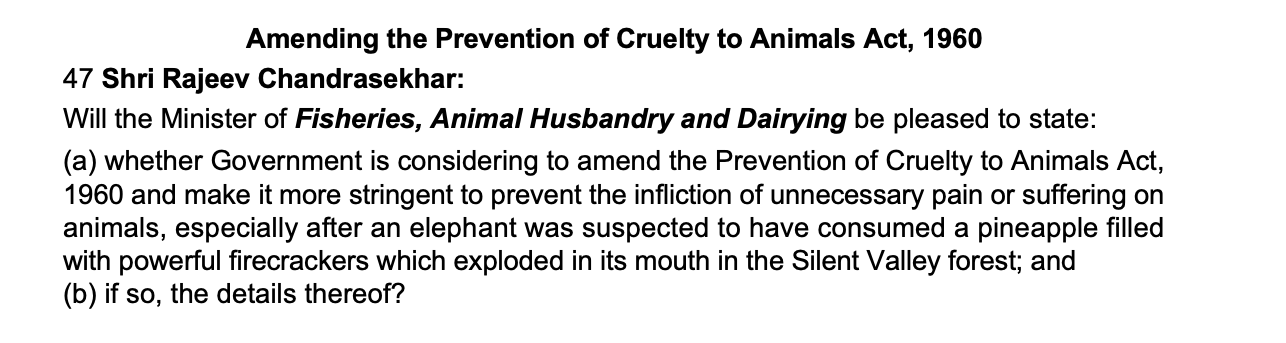

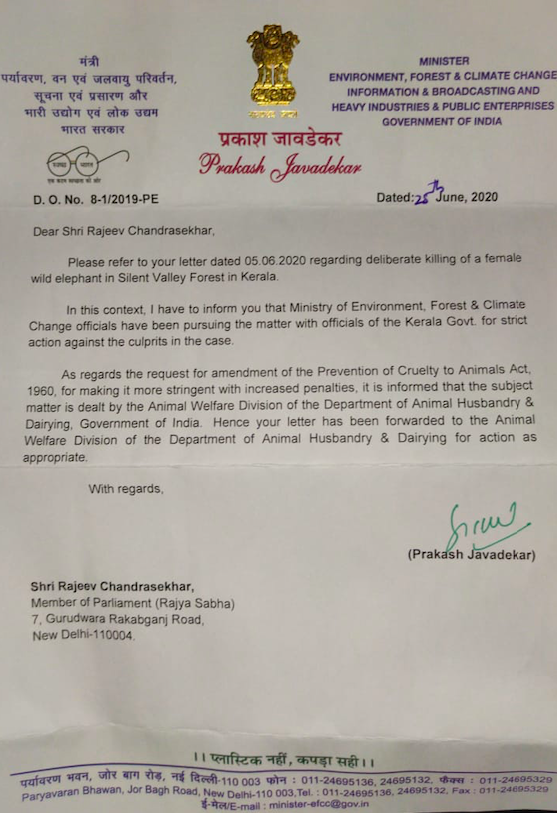

Fisheries, Animal Husbandry and Dairying

Starred Question No : 47 Parliament Session 253 -

Structural Changes in System of Corporate Governance

Unstarred Question No : 2567 Parliament -

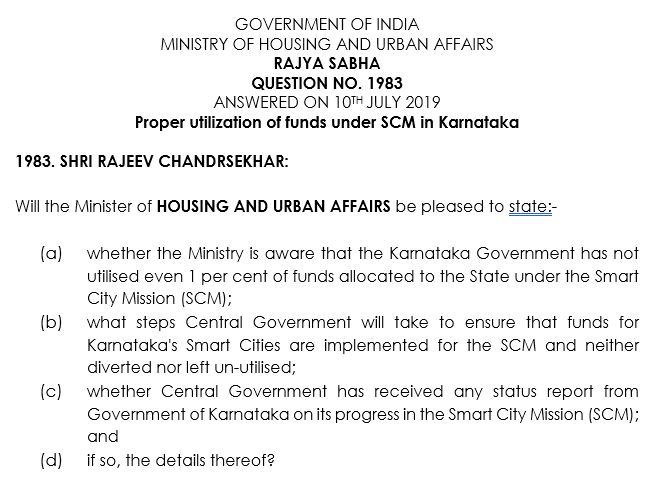

Proper utilization of funds under SCM in Karnataka

Unstarred Question No : 1983 Parliament -

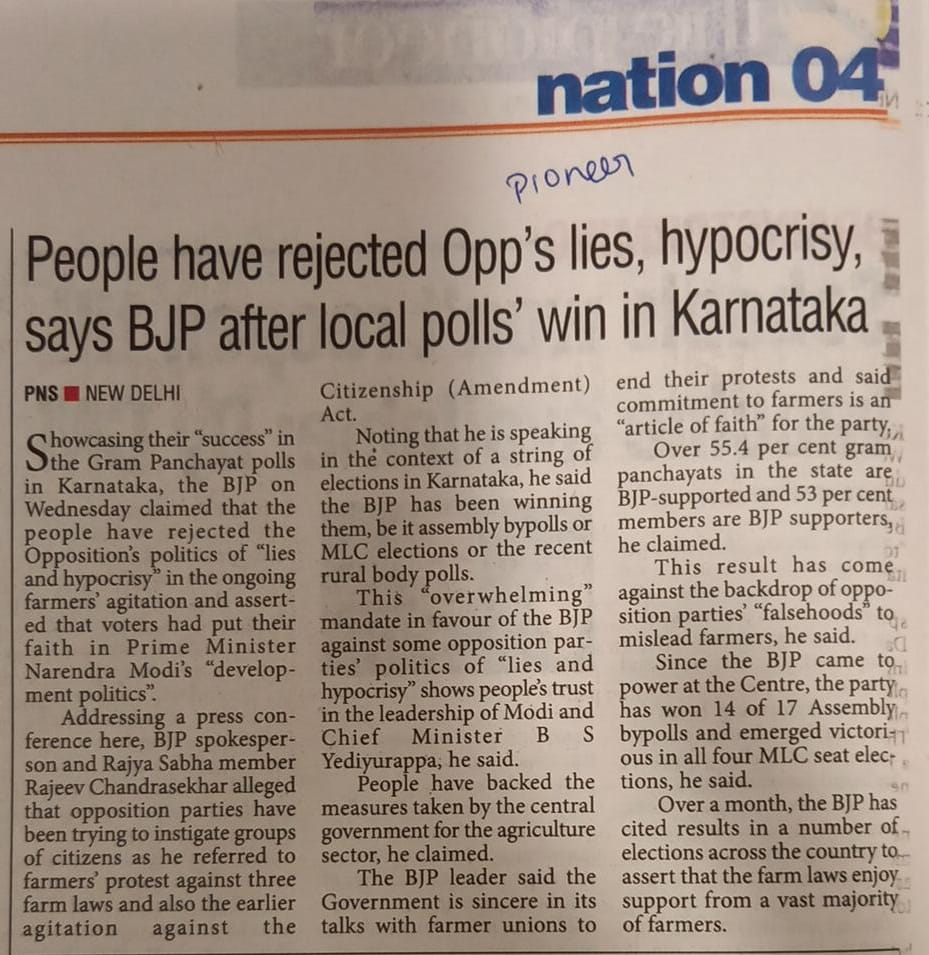

BJP MP Rajeev Chandrasekhar says Dr Manmohan Singh’s jobless growth charge is factually wrong

New Indian Express Financial Express Online Zee News Hindu BusinessLine Deccan Herald Moneycontrol.com Asian Age Deccan Chronicle Business Standard Business Standard Devidiscourse ProKerala.com HansIndia.com Can India.com Outlook Quint Social News XYZ India.com WebIndia123 Weekender Leader IndiLeaks.com New Kerala SME Times India Finance News E Vartha TechGraph -

FOREIGN NATIONAL IN RESTRICTED AREA IN ANDAMAN AND NICOBAR ISLANDS

Starred Question No : 105 Parliament Session 247 -

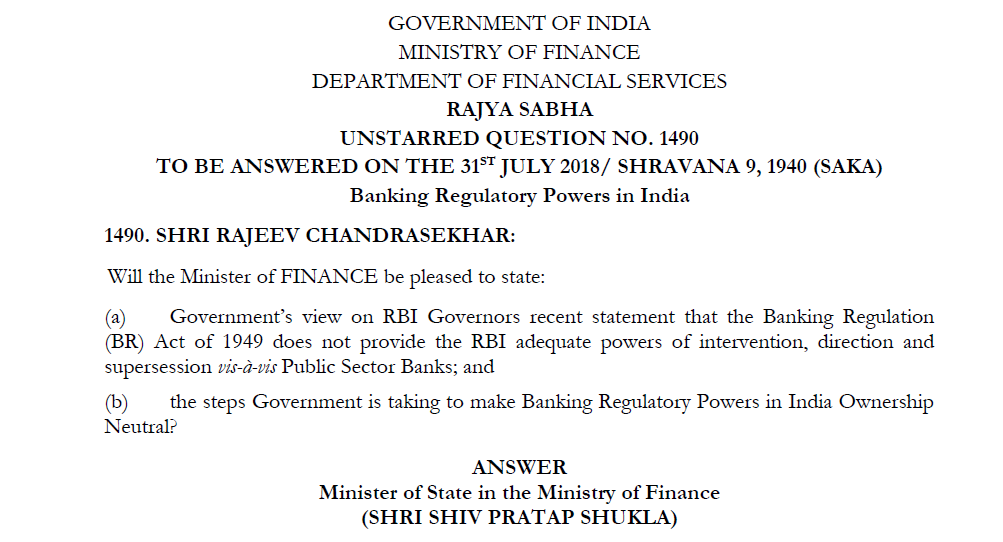

Role of the Department of Financial Services and RBI vis-à-vis performance of PSBs

Unstarred Question No : 827 Parliament Session 247 -

Review of Functioning of Independent Regulators

Starred Question No : 149 Parliament Session 240 -

Start up India Coverage and Eligibility

Unstarred Question No : 295 Parliament Session 240 -

Development of Long Term Debt Markets for Financing Infra Projects

Unstarred Question No : 196 Parliament Session 240 -

Role of external independent directors in PSBs as regards NPA

Unstarred Question No : 211 Parliament Session 239 -

Recommendations of Kelkar Committee on Public Private Partnerships

Unstarred Question No : 227 Parliament Session 239 -

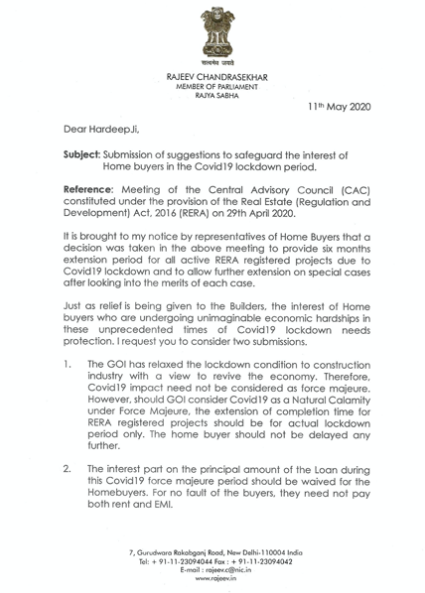

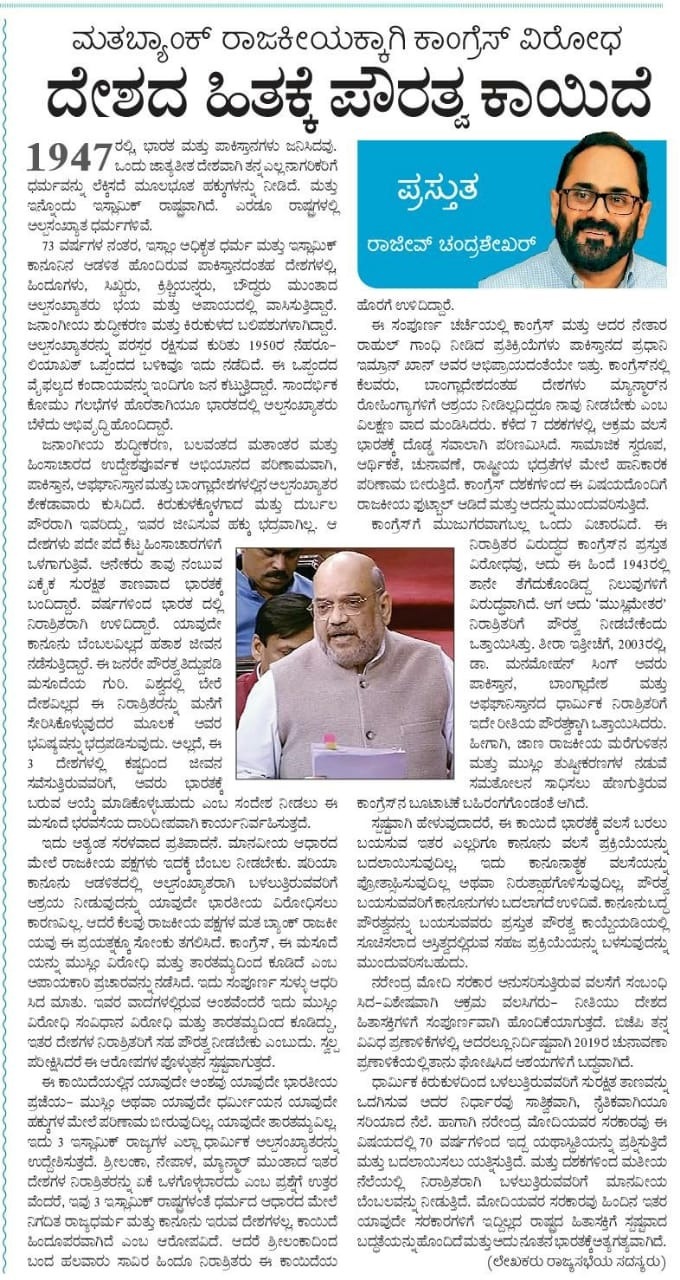

Real Estate Bill is a boon for Home Buyers

Financial Express Deccan Chronicle Kannada Prabha Udayavani CNBC - TV 18 - Part 1 CNBC - TV 18 - Part 2 Magicbricks NOW 01 Magicbricks NOW 02 ET NOW MoneyLife.in Amar Ujala Asian Age Hindustan Times Malayalam Manorama DNA EconomyLead.com Deccan Herald Sify.com NDTV Profit Business Standard Business Standard Business Standard Deccan Chronicle Big News Network New Kerala Asian Age India Today Firstpost IBN Live Yahoo News India Infoline Latest Laws Cops 2 Point 0 E Newspaper of India Yahoo Finance 1 Yahoo Finance 2 Tell Me Boss Daily World ET Realty City Air News Rediff.com International Business Times RauIAS The Siasat Daily IBN 7 India Online Nerve.in Nerve.in This is my India Can-India.com The Day After Accommodation Times Web India Outlook SME Times Sentinel Assam Live Uttar Pradesh Apkaangan Aaj ki Khabar Desh Gujarat Chennai Online The Hindu The Hindu Hindustan Times -

Risk for concentration of Net Worth in Banking System

Unstarred Question No : 63 Parliament Session 234 -

Recapitalization of Public Sector Banks (PSBs)

Unstarred Question No : 2068 Parliament Session 230 -

“Who pays the price for biometric scan ATMs?” Rajeev writes to The Prime Minister, Finance Minister & Chairman – Standing Committee on Finance

Money Life Business Standard Economic Times msn NEWS Money Life RBI Governor Media Nama Live Mint Money Life Pvt. Firm to use Aadhar Bridge for Salary Payment - Medianama Supreme Court says Aadhaar data cannot be shared with Govt agencies without user consent - Medianama RBI puts on hold Aadhaar-based biometric authentication in PoS terminals ? Medianama Money Life -

Loan restructuring of Public Sector Units (PSUs)

Unstarred Question No : 2199 Parliament Session 227 -

Involvement of Bank Officials in Frauds Cases

Unstarred Question No : 5003 Parliament Session 225 -

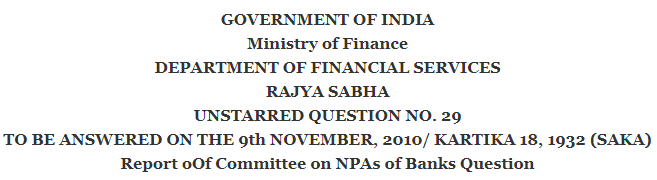

Report of Committee on NPAs of Banks Question

Unstarred Question No : 29 Parliament Session 221 -

Rising Non-Performing Assets (NPA) Level of Public Sector Banks

Unstarred Question No : 178 Parliament Session 220